Manual invoice processing often leads to delays, data entry errors, and compliance risks. As companies grow, automating this function becomes essential.

In 2025, 52% of AP professionals now spend fewer than ten hours per week on invoice processing. Manual entry into ERP systems has dropped to 60%, showing a clear move toward automation.

Dynamics 365 Finance and Operations vendor invoice automation streamlines this process by digitizing invoice capture, validation, approval, and posting. It helps finance teams speed up processing, ensure accuracy, and maintain vendor relationships.

This blog explores key features, setup options, and how to make the most of Dynamics 365 Finance and Operations vendor invoice automation in your organization.

Vendor Invoice Automation in Dynamics 365 Finance and Operations helps organizations minimize manual invoice processing by automating the intake, matching, approval, and posting of vendor invoices. It integrates tightly with the procurement and accounts payable modules, offering end-to-end control and visibility.

Automating accounts payable ensures that incoming invoices are processed faster and more accurately. It reduces the need for repetitive data entry, eliminates paper-based workflows, and enables real-time tracking of invoice statuses. This is especially valuable for enterprises handling high invoice volumes across multiple vendors.

Manual invoice handling is prone to delays, duplicates, and approval bottlenecks. Paper trails make it hard to track accountability, and any inconsistencies can disrupt compliance during audits. Automation resolves these issues by standardizing processing rules and enabling straight-through invoice processing.

Implementing these benefits begins with proper configuration inside Dynamics 365. Here’s how to set things up.

Implementing Dynamics 365 Finance and Operations vendor invoice automation requires configuring specific modules and parameters to support your business logic. Here’s how you can set it up:

Beyond the basics, D365 Finance includes advanced tools to fine-tune and optimize your invoice management system.

Once the foundational setup is in place, Dynamics 365 Finance and Operations vendor invoice automation offers advanced capabilities to handle more complex invoice scenarios. These features help streamline financial controls and improve compliance.

You can configure D365 to automatically link vendor invoices with prepayment transactions. This ensures the invoice amount reflects any prior advance payments and supports correct accounting treatment.

Invoice pools serve as holding queues for incoming invoices that require review or additional data. This is especially useful for:

Finance teams can define rules to determine how invoices enter and exit these pools, keeping non-standard cases organized.

Tolerance policies help the system decide how to process discrepancies in invoice matching. For example:

This reduces unnecessary rejections while keeping financial accuracy in check.

To understand how these advanced features integrate with your existing accounts payable workflows, you can review Microsoft’s invoice matching and prepayment setup. To further enhance these capabilities, integration with external tools can significantly boost efficiency and accuracy.

To further optimize the Dynamics 365 Finance and Operations vendor invoice automation process, businesses can integrate Optical Character Recognition (OCR) and electronic invoicing solutions. These tools minimize manual data entry, reduce errors, and accelerate processing times.

OCR tools scan and extract data from paper or PDF invoices and feed it directly into Dynamics 365. Once captured, the system validates the data based on your configured rules.

Key advantages:

For businesses receiving digital invoices via XML, EDI, or PDF, electronic invoicing enables seamless invoice ingestion.

Capabilities include:

Many companies use built-in connectors or external services like Microsoft’s Electronic Invoicing Add-in to enable smooth, secure integrations with tax authorities and vendors.

By embedding OCR and e-invoicing tools into your D365 workflows, your AP department can shift from reactive to proactive invoice handling, cutting down processing time significantly.

After invoices are captured and matched, the next critical step is managing approvals. Dynamics 365 Finance allows you to configure role-based approval workflows that align with your company’s financial policies and hierarchy.

Approval workflows can be tailored using condition-based logic to match business rules such as:

These workflows are managed within the Accounts Payable module using the Workflow Editor. Administrators can assign steps based on user roles, amounts, or vendor categories.

To ensure timeliness, Dynamics 365 includes escalation and delegation options:

The system logs each approval action, comment, and timestamp. These audit trails are especially valuable for internal controls and external compliance audits, ensuring that every approval step is both traceable and defensible.

For advanced workflow scenarios, organizations can also integrate Power Automate to connect invoice approvals with Microsoft Teams, Outlook, or other applications.

Once automation is in place, tracking performance becomes critical. Dynamics 365 Finance provides built-in dashboards and customizable reports to help you monitor invoice processing efficiency and compliance.

Key Metrics Tracked

These insights help identify bottlenecks, reduce processing delays, and support continuous improvement.

For deeper visibility, you can integrate Dynamics 365 Finance with Power BI. This allows you to build real-time dashboards that highlight trends across vendors, departments, or time periods. Custom visuals and drill-downs enable stakeholders to explore root causes and make informed decisions.

All invoice events such as capturing, matching, approvals, and exceptions are logged. This creates a transparent audit trail that simplifies external audits and supports internal governance.

Microsoft offers detailed guidance on using analytics tools within the system to improve process visibility and compliance.

Getting Dynamics 365 Finance and Operations vendor invoice automation right isn't just about initial setup. To maintain efficiency and compliance over time, consistent refinement is essential. These best practices help ensure your automation framework keeps delivering value.

Instead of launching automation across all vendors at once, begin with a pilot group. This lets your team validate the setup and adjust before full-scale implementation.

Avoid blanket approval processes. Set dynamic thresholds based on invoice amounts or categories to minimize manual reviews for low-value invoices.

Use the built-in audit functionality in D365 Finance to track approval times, changes, and user actions. This is vital for financial transparency and external audits.

Integrate AI-driven Optical Character Recognition (OCR) for paper-based invoice capture. Microsoft’s AI Builder can help automate document recognition and data entry.

D365 Finance frequently adds enhancements to automation modules. Stay updated and retrain relevant users on any new capabilities or UI changes.

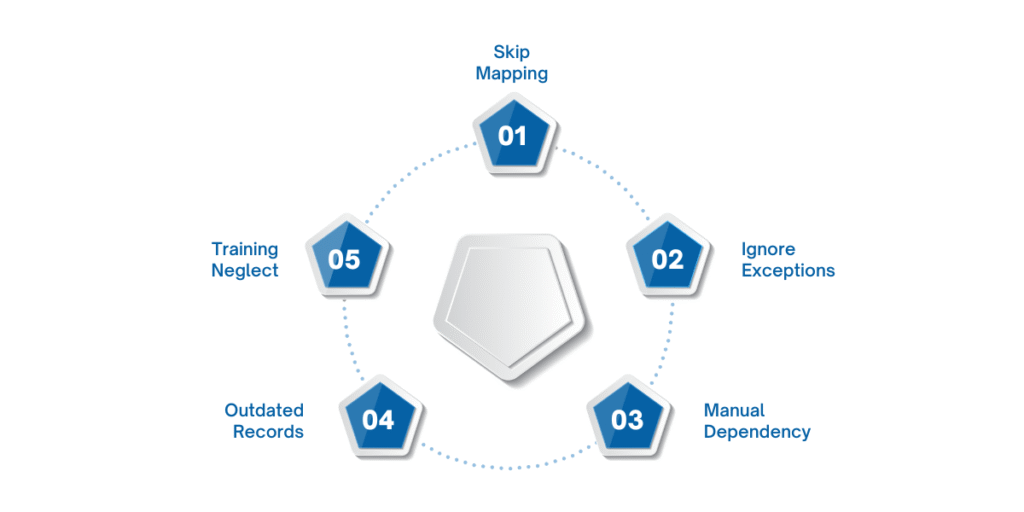

Even with the best intentions, some missteps can derail automation efforts. Here’s how to avoid them.

While Dynamics 365 Finance and Operations vendor invoice automation streamlines processes, improper configuration can lead to bottlenecks or compliance gaps. Understanding what to avoid is key to long-term success.

Incorrect or incomplete mapping of vendor invoice fields often leads to mismatches and exceptions.

Tip: Ensure every data field, including invoice number, date, amount, and vendor ID, is correctly mapped from scanned invoices or integrated portals.

Failing to define how exceptions like duplicates, missing fields, or invalid POs should be routed can delay processing.

Tip: Establish exception workflows with fallback approvers and error notifications to maintain efficiency.

If too many approvals are hardcoded, you lose the flexibility and speed automation is meant to provide.

Tip: Use conditional logic to trigger approvals only when thresholds or risk factors are met.

Outdated or inaccurate vendor records can cause failed matches and unnecessary reviews.

Tip: Regularly audit and update your vendor master to maintain automation accuracy.

Automation features are only effective if users know how to interact with them properly.

Tip: Conduct short training sessions for AP staff and approvers. Cover dashboard usage, exception handling, and approval actions.

Avoiding these pitfalls keeps your automation on track, but choosing the right partner can help you get it right from the start.

Automating vendor invoice processes in Dynamics 365 Finance and Operations is more than just a convenience. It directly impacts cash flow, compliance, and productivity. When configured properly, it reduces manual workload, improves visibility, and ensures faster approvals with fewer errors.

From defining automation rules to integrating OCR and setting up approval workflows, each step plays a role in how efficiently your accounts payable team can operate. As invoice volumes grow and audit requirements tighten, relying on manual processes becomes risky and unsustainable.

That is why working with a partner like WaferWire makes a difference.

Vendor invoice automation in Dynamics 365 Finance and Operations requires more than just technical know-how. It demands an understanding of how your finance team works, what compliance looks like in your region, and how to keep operations audit-ready and scalable. That is where WaferWire delivers real value.

Ready to make invoice handling faster, smarter, and fully compliant? Get in touch with WaferWire today.